Electric South > North Carolina

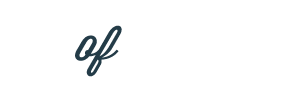

Resources: A measure of total energy production and consumption per capita

Market: The cost of consumption, measured in electricity prices and gasoline taxes

Infrastructure: Capacity to generate and refine energy sources; miles of pipelines

North Carolina has no crude oil reserves, production, refineries or pipelines. Petroleum product imports are brought into the state through the Port of Wilmington.

Three major natural gas pipelines currently cross the state, and a planned expansion in the future could link the state to shale gas production from the Marcellus and Utica shales to the north.

North Carolina's motor gasoline tax is among the highest in the nation.

Production trillion btu

Oil

Gas

Coal

Wind

Solar

Hydro

Biofuel

Nuclear

net energy Production trillion btu

Consumption trillion btu

Oil

Gas

Coal

Renewable

Nuclear

Gasoline Tax total state + federal, 2014

NC

USA

Key Policies

Requires investor-owned electric utilities to meet 12.5% of their retail electricity sales through renewable energy resources or energy efficiency measures by 2021. Rural electric cooperatives and municipal electric suppliers must acquire 10% of retail electric sales from renewable resources by 2018.

Requires motor gasoline to be formulated to reduce emissions in several of the more densely populated counties in the state.

Requires a permit and compliance bond for oil and gas well drilling. Permit fees begin at $3,000. Compliance bonds begin at $5,000 per well and increase for deeper wells.

Electricity net production, trillion btu

NC

USA