Mineral-Rich Mountains > Colorado

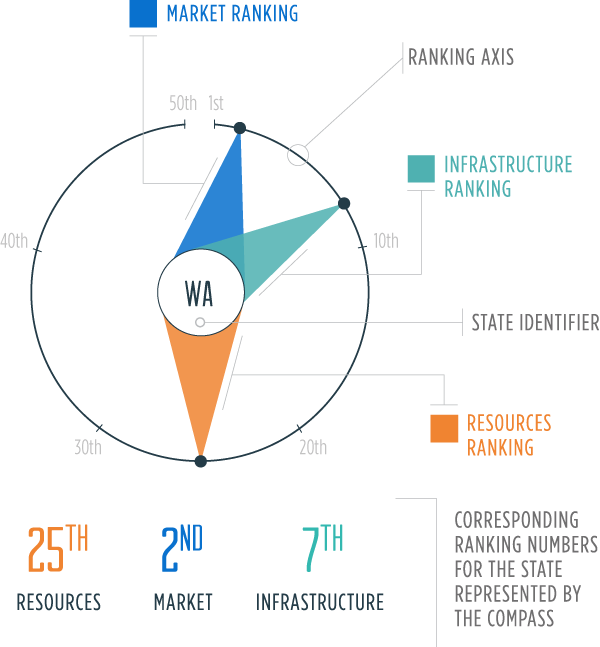

Resources: A measure of total energy production and consumption per capita

Market: The cost of consumption, measured in electricity prices and gasoline taxes

Infrastructure: Capacity to generate and refine energy sources; miles of pipelines

The mining sector—including petroleum, natural gas and coal extraction—was Colorado's fastest-growing economic sector between 2003 and 2013, with a compound annual growth rate of 16.5%. Production in this sector increased 238% over that same period.

Average household energy costs in Colorado are 23% lower than the national average, mostly due to to low natural gas prices.

The demand for petroleum products in Colorado exceeds the state's refining capacity. Several petroleum product pipelines—including those from Wyoming, Texas and Kansas—help supply the Colorado market, and more pipelines are being built or repurposed to take Colorado crude oil to refineries out of state.

Production trillion btu

Oil

Gas

Coal

Wind

Solar

Hydro

Biofuel

Nuclear

net energy Production trillion btu

Consumption trillion btu

Oil

Gas

Coal

Renewable

Nuclear

Gasoline Tax total state + federal, 2014

CO

USA

Key Policies

Requires investor-owned electric utilities to provide 30% of their generation from renewable energy resources by 2020, with 3% coming from distributed generation.

Requires the use of oxygenated motor gasoline to limit smog formation in the Denver-Boulder and Ft. Collins areas.

Requires permits and compliance bonds for oil and gas well drilling. Bonds begin at $2,000 per for well for non-irrigated land or $5,000 per well for irrigated land.

Electricity net production, trillion btu

CO

USA